Facing financial situations can be difficult to navigate and you might need assistance with a loan. There are different types of loans to choose from and we break down the types of loans that work the best for certain lifestyles.

One of the most common types of loans is a student loan that helps people seeking higher education but lack the funding. A student loan can be used to pay for tuition, books, housing, and other education-related costs.

Student loans are for educational costs, but most lenders don’t monitor how the money is spent with primary sources of student loans coming from the federal government or private companies. The common student loan can start at $30,000 with a payoff timeline for up to 10 years and in some cases up to 25 years. The APR for federal student loans range from 5% to 8% and the APR for private student loans range from 4% to 14% with a possible forgiveness period after 10 years for public service works (20-25 years for others).

Another common loan is a mortgage for buying property, but you should know the terms of this type of loan stipulates the financial institution that issues the loan owns the house until your mortgage is paid off. Mortgage loans can come from the government (USDA, FHA, VA) or private companies with a time period ranging from 10 to 30 years. Mortgage loans typically have an APR of 3% to 6% with a required credit score of 580 for government-insured loans and 620 for private loans.

If you need some financial assistance for your vehicle, you can consider getting an auto loan. Auto loans are secured by the vehicle being financed and if the borrower won’t make payments, the lender can repossess the car to regain losses.

The rates of auto loans can fluctuate depending on variables including whether the car is new or used and how long the loan lasts with the typical payoff timeline ranging from 24 to 72 months. The APRs for auto loans range 3% to 7% and there is no credit score requirement.

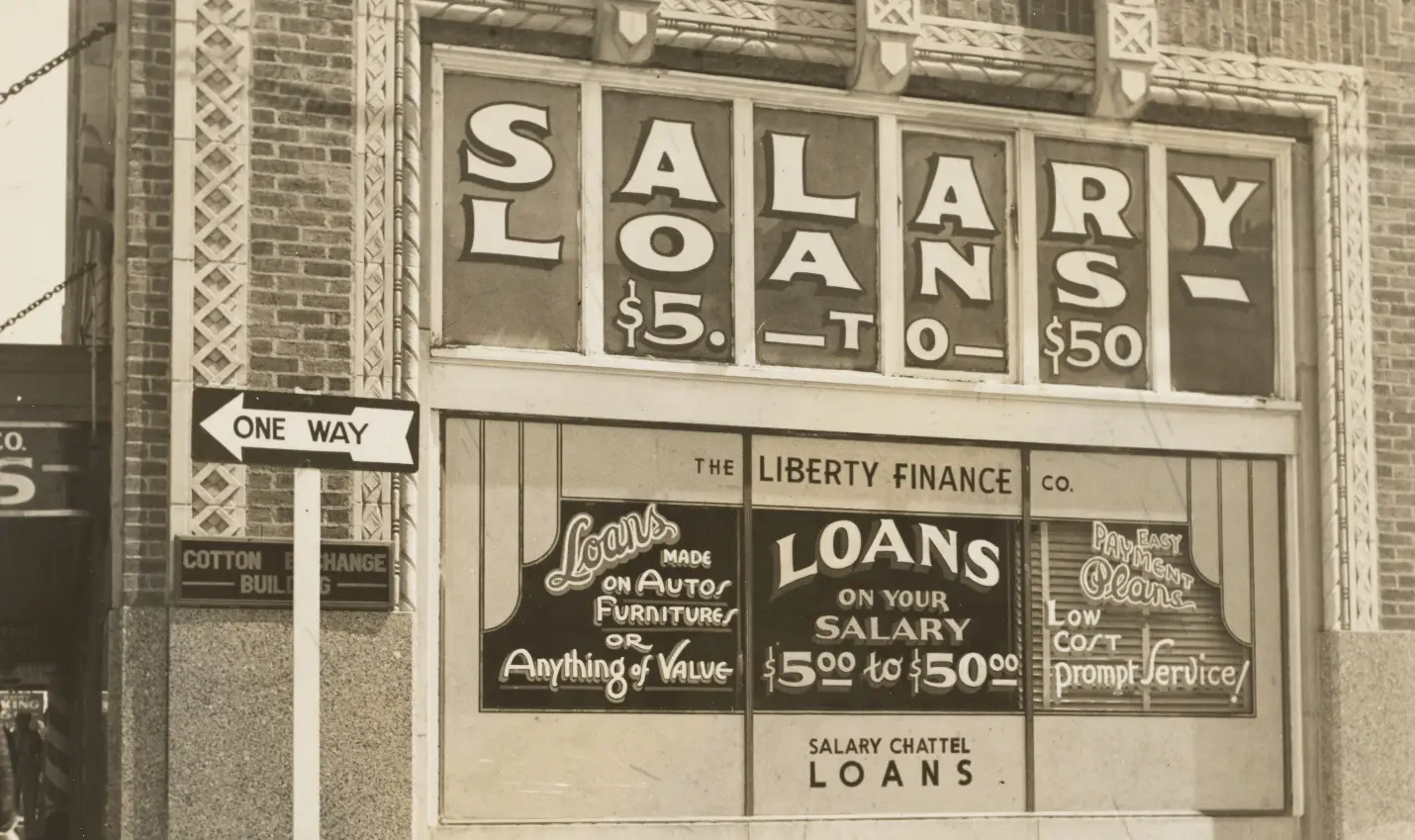

Pay day loans can help when you’re short on cash but can be considered one of the riskiest loans. This type of loan are short-term loans that is required to be paid back with interest after the borrower receives their next check.

These loans typically are for $500 or less that is considered risky as lenders will often charge one of the highest fees equal to a 400% APR. This loan is available to people with bad credit because the loans are secured by the borrower’s upcoming paycheck. Due to the extremely high cost, this loan isn’t worth pursuing. The research for this article was sourced from Wallet Hub.